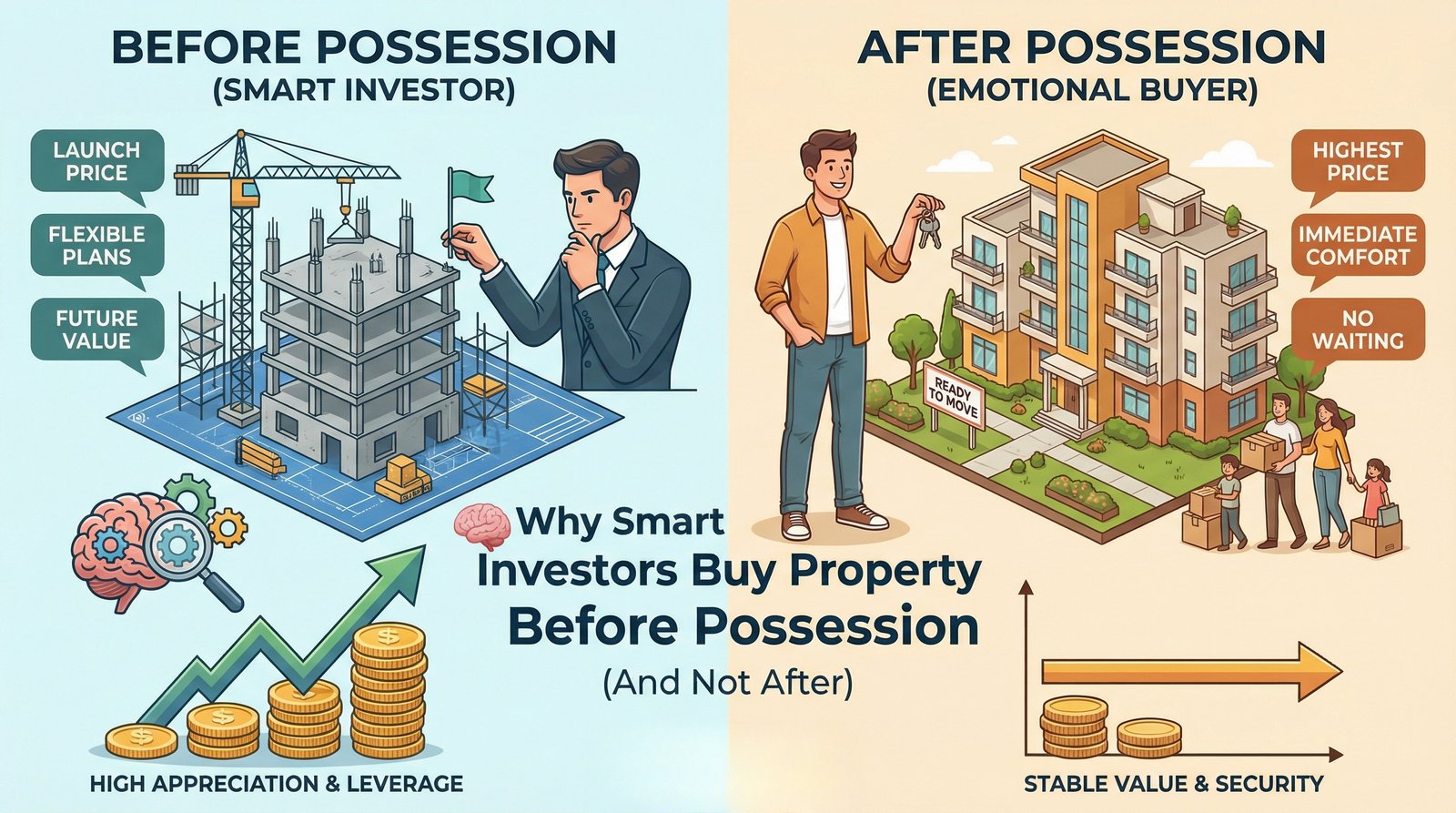

When people plan to buy a home, the safest option usually feels obvious — a ready-to-move apartment.

You can see the flat, inspect the quality, check surroundings, and shift immediately. No waiting, no uncertainty, no construction risk.

But here is the interesting reality:

Most experienced real estate investors do not buy ready homes.

They intentionally buy under-construction properties — often 2 to 4 years before possession.

Why would someone invest crores in something that is not even built yet?

Because in real estate, profit is not created when the building is completed.

Profit is created during construction.

Understanding this single concept can completely change how you invest in property and can save — or earn — you lakhs to crores over time.

Let’s break this down in a very simple way.

The Real Estate Price Cycle (The Most Important Concept)

Every residential project follows a predictable growth pattern.

Whether it is a luxury high-rise, builder floor, or township — the cycle remains almost the same.

Stage 1 – Launch Phase

The project is announced. Construction has just started or about to begin.

-

Lowest price

-

Maximum uncertainty

-

Highest future potential

-

Mostly investors enter here

Stage 2 – Construction Phase

Structure starts rising. Buyers can see physical progress.

-

Confidence improves

-

Demand increases

-

Prices start rising steadily

Stage 3 – Near Possession

Finishing work ongoing. Property looks almost ready.

-

End users start buying

-

Price becomes premium

-

Appreciation slows down

Stage 4 – Ready to Move

Families shift in.

-

Emotional buying begins

-

Price highest

-

Growth becomes stable

Price vs Buyer Psychology

| Stage | Price Level | Buyer Type |

|---|---|---|

| Launch | Lowest | Smart Investors |

| Construction | Medium | Early Buyers |

| Near Possession | High | End Users |

| Ready to Move | Highest | Emotional Buyers |

👉 The biggest appreciation happens between launch and possession

After possession, price stabilizes instead of multiplying.

Why Appreciation Happens Before Completion

Real estate value depends on certainty.

At launch, the future is unclear:

-

Will construction finish?

-

Will area develop?

-

Will roads complete?

Because of uncertainty → prices stay low.

As construction progresses:

-

Risk reduces

-

Demand increases

-

Prices rise

By possession time:

Everything becomes visible → value already captured.

So ready-to-move buyers pay the final price, not the growth price.

Real Example of Property Appreciation

Let’s understand with a realistic luxury project scenario.

| Stage | Price Per Sq.ft |

|---|---|

| Launch | ₹9,000 |

| Mid Construction | ₹12,500 |

| Possession | ₹16,500 |

| Ready to Move | ₹18,000+ |

Difference between launch and possession = ₹7,500 per sq.ft

For a 2000 sq.ft apartment:

Profit = ₹1.5 Crore+ (approx)

And this growth happened before the buyer even got keys.

This is why investors focus on entry timing — not possession timing.

The Biggest Advantage: Leverage Power

Under-construction property allows something extremely powerful:

You control a big asset using a small amount of money.

Example:

Property Value = ₹3 Crore

Initial Payment = ₹30–60 Lakhs

You own appreciation of ₹3 Cr asset by blocking only small capital.

This is called financial leverage.

Wealthy investors use leverage everywhere — stocks, businesses, and real estate.

Ready property requires full payment → no leverage → limited returns.

Flexible Payment Plans (Major Investor Attraction)

Builders offer attractive payment structures in early stages:

Construction Linked Plan

Pay gradually according to construction progress.

30:70 Plan

Pay 30% now and 70% at possession.

20:80 / No EMI Till Possession

No bank EMI burden during construction period.

Meaning:

Your money stays safe while asset keeps appreciating.

Why End Users Prefer Ready Property

Families prioritize comfort and certainty.

They want:

-

Immediate shifting

-

No waiting period

-

Physical inspection

-

Emotional satisfaction

And that is perfectly correct for living purpose.

But financially, they enter at the final stage — when appreciation is mostly over.

They buy security, not growth.

Appreciation vs Safety

| Type | Safety | Profit Potential |

|---|---|---|

| Ready to Move | Very High | Low |

| Under Construction | Medium | Very High |

Smart buyers balance both by choosing reputed developers in developing locations.

Biggest Mistake Buyers Make

Many buyers believe:

“I will buy after possession to avoid risk.”

But what actually happens:

They avoid construction risk

But accept pricing risk.

Because by possession, prices already increased 30%–70%.

So they exchange uncertainty for cost — often unknowingly.

Important Rules Before Buying Under-Construction

Never invest just because price looks cheap.

Smart investors check four things:

1. Developer Track Record

Past delivery history matters more than brochure promises.

2. Location Growth Potential

Infrastructure drives appreciation, not just project amenities.

3. Construction Progress

Active construction reduces risk dramatically.

4. Legal Approvals

RERA registration & clear documentation essential.

When these are satisfied → risk reduces → returns remain high.

2026 Market Reality (Current Opportunity)

In developing corridors, growth cycle still active.

When:

-

Roads complete

-

Metro operational

-

Families shift

Prices stabilize permanently.

Meaning:

Early buyers gain appreciation

Late buyers gain satisfaction

Both are happy — but returns differ massively.

Investor Mindset vs Buyer Mindset

Investor asks:

“What will this cost in future?”

End user asks:

“What is price today?”

That one difference decides profit.

Long Term Wealth Creation Strategy

Many experienced investors follow a cycle:

-

Buy during launch

-

Hold till possession

-

Exit or refinance

-

Upgrade to bigger asset

This compounds wealth without heavy EMI burden.

Instead of buying one expensive ready flat, they gradually move to premium properties using appreciation.

When Ready Property Still Makes Sense

Ready-to-move is ideal if:

-

Immediate shifting required

-

Emotional security priority

-

No investment intention

-

Budget flexibility available

But if goal is wealth creation → timing matters more than completion.

Final Advice

Real estate success depends less on what you buy

and more on when you buy

Buying early in the right project:

-

Reduces capital requirement

-

Maximizes appreciation

-

Builds long term wealth

Buying late:

-

Reduces uncertainty

-

Reduces returns

Both are correct decisions — depending on your goal.

Want Expert Guidance?

At Kapoor Buildtech Pvt. Ltd., we identify projects where growth is still pending — not already finished.

We help you enter at the right stage based on:

-

Budget comfort

-

Holding period

-

Investment vs living purpose

📞 Call / WhatsApp: +91 9711966669